SERI is the housing body and ANSI-accredited Standards Development Organization for the R2 Standard has released the latest revision to the R2 Standard Version 3.0.

The electronics industry is constantly changing and to keep pace, our best practices and standards need to evolve as well. R2v3 incorporates our experience gained from more than a decade auditing and implementing the R2 Standard and reflects changes in the electronics landscape, customer demands, and the regulatory environment.

This post will explain the transition timeline for those company’s who are already certified to R2:2013 as well as provide a brief overview of the key changes captured in the new R2v3 Standard.

Also you can download a copy of latest R2v3 Standard below.

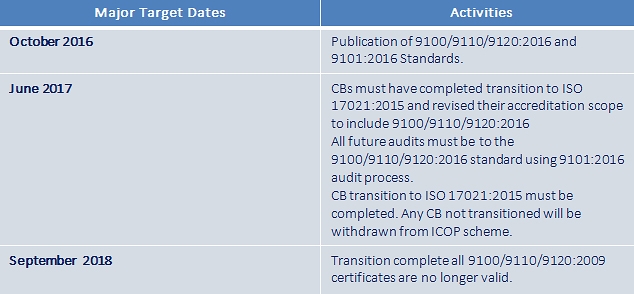

R2v3 Upgrade Transition Timeline

Summary of CORE Requirements

Core Requirements 1-10 are applicable to all R2 facilities. The Process Requirements are additional requirements that apply only to R2 facilities that perform those specific processes. Many Process Requirements are based on R2:2013 requirements, but are reorganized, clarified and/or enhanced to achieve more consistent implementation and outcomes.

Facilities are not required to perform all R2-related processes in order to be R2 Certified. It is important to note, however, that all R2-related processes performed at a facility must be audited and cannot be excluded from R2 Certification.

Certified specialty processes will be included on the R2 Certificate to provide customers or suppliers more information about the expertise and capabilities of each R2 Certified facility.

Scope

Added scope requirements to ensure transparency and that all R2-related activities performed by a facility are audited and included on the R2 Certificate.

Revised the definition of “scope” to clarify included and excluded operations/activities.

Hierarchy of Responsible Management Strategies

1. Focus remains on reuse before other management strategies. This core principle of R2 is aligned with the global trend towards a more circular economy.

2. Focus Materials continue to be prohibited from disposal.

EH&S Management System

1. Includes all of the core EH&S related requirements in the same section for greater clarity and efficiency. Removed redundant requirements.

2. Increased emphasis on risk assessment, inspection, and monitoring activities to ensure potential hazards are being identified and managed.

Legal & Other Requirements

1. Separated compliance monitoring into individual requirements to ensure adequate coverage of each.

2. New requirements: prohibition on the use of child and forced labor; and developing and maintaining a non-discrimination policy.

Tracking throughput

New requirements for tracking /managing /maintaining records for all equipment managed.

• New requirements regarding inventory levels and storage of R2 controlled streams.

• More clarity regarding inbound, under control, and outbound equipment.

Sorting, Categorization and Processing

Simplified the new R2 Equipment Categorization (REC) reference document that is to be used in conjunction with the R2v3 Standard to identify the functional, cosmetic, and data sanitization status of electronic equipment, components and materials.

• More clarity about the processing paths for R2 Controlled Streams.

• Permits facilities to use their own internal categories if they are mapped to corresponding categories in the REC.

Data Security

1. Enhanced requirements for securing the facility; receiving and securing data containing equipment; and securing and tracking equipment during transport.

2. Defines the approved methods for sanitizing equipment in a timely & effective manner

Focus Materials

1. Requires Focus Material management plan and downstream flowchart to final disposition or to the first R2 Facility.

2. Existing R2:2013 requirements for Removal of Focus Materials (FM) and Selection of Downstream Vendors move to PROCESS Requirements.

Facility Requirements

Defines requirements for processing and storage areas.

• Requires an evaluation of risk and insurance for injury/illness.

• Requires closure plan and financial assurance.

• Pollution liability insurance moved to PROCESS Requirements.

Transport

Proper packing of equipment, components, and materials during transport to prevent environmental, health, or safety hazards; and to secure data containing items.

• Clear and accurate labeling and shipping documents.

• All transport, including import/export, must be in compliance with legal requirements.

Summary of PROCESS Requirements Changes

Downstream Recycling Chain

Option for facilities to track entire downstream chain, OR register their portion of the chain with SERI and stop tracking at the first R2 Certified facility.

1. R2 facilities must confirm with records the receipt of all Focus Materials by the downstream vendor.

2. Enhanced requirements for verifying non-R2 downstream vendors for data sanitization.

Data Sanitization

1. Core Requirements for Data Security (R2v3 Prov. 7) apply to ALL R2 Certified facilities. Appendix B-Data Sanitization provides an enhanced level of security, practices, verification, and tracking.

2. Covers all logical sanitization activities, as well as any physical destruction where additional tracking and verification of sanitization is required.

3. Additional quality controls to confirm successful sanitization and identify any discrepancies.

Test and Repair

Applies to facilities performing test & repair in-house.

• Must be certified to Quality Management System standard ISO 9001 or RIOS.

• Data must be sanitized in accordance with the requirements of Appendix B.

• Requires detailed R2 Reuse Plan for test and repair by equipment type; test results recorded for each function tested; and product safety evaluation.

• 1 year limit to process equipment and components.

• Technical competency requirements for workers

Specialty Electronics

1. New requirements for R2 Facilities concentrating on specialty equipment markets such as medical and commercial telecom equipment. Allows specific verifications where full testing is not possible.

2. This Process Requirement will not eliminate the ability for most R2 facilities to sell Specialty Equipment for Reuse under the 1% rule

Materials Recovery

Required for facilities engaged in processing electronics for materials recovery

(e.g. manual dismantling, mechanical separation, or other engineered methods).

• Requires Environmental Pollution Liability Insurance.• Additional EH&S hazard identification and controls.

• Enables precious metal refiners, lead smelters, battery recyclers, etc. to be R2 Certified

Brokering

Requirements for brokering only (no facility), AND for facilities that perform brokering services.

• Requires QMS Certification (ISO 9001 or RIOS) for brokering activity.

• Certified to Process Requirement A - Downstream Recycling Chain.

• Must provide packaging requirements to seller prior to shipment in accordance with CORE 10 Requirements